Trends in electronic commerce that merchants and acquirers can’t ignore

Let’s have a look at the recent trends in electronic commerce from the perspective of both the acquirer and the merchant. Why is this important? Following trends and implementing the know-how of the industry allows acquirers to tap into new revenue streams, retain existing merchants, gain new market share and maximize the returns. From the e-commerce merchant perspective, following trends allows them to reduce their costs, increase conversion, increase sales, and improve operations. There are several important trends that have emerged recently, and will continue to develop in 2019-2020, that are affecting both the acquirer and the e-commerce merchant:

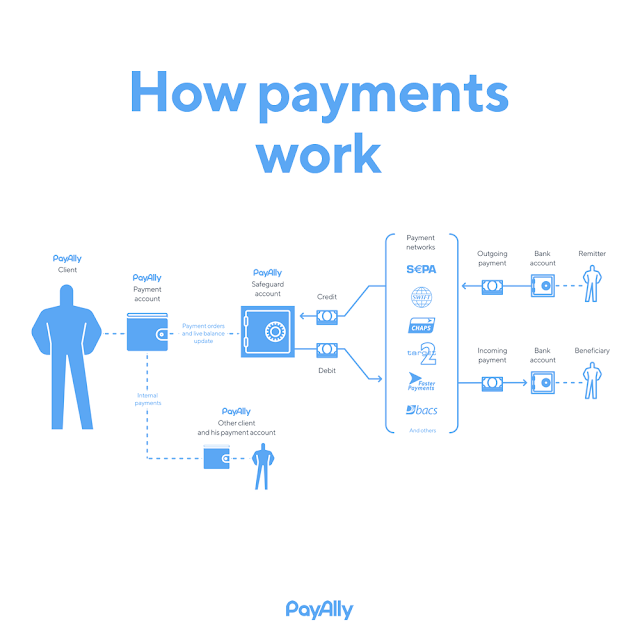

Acquirers are actively tapping into transactional banking services

This trend has emerged on the liberalization of the EU banking and payments market, following introduction of PSD2 new opportunities arose for payment service providers. The notion of open banking changed the attitude of banks towards other authorized financial institutions, by shifting their attitude from competition to collaboration. This change in legislation and shift in perspective allowed authorized payment institutions and electronic money institutions to join banking payment clearing and settlement schemes such as SEPA, Target2, Bacs, CHAPS and Faster Payments. Other countries worldwide have followed the suit and opened up their clearing and settlement schemes for payment institutions. As a consequence, acquirers that are licensed as authorized payment institutions and electronic money institutions have started offering transactional banking services to their e-commerce merchants, which are creating many benefits for both parties, to name a few:

- Current accounts (ease of settlements of e-commerce sales proceeds);

- Local and cross border payments (in most cases cheaper than banks);

- Settlements in foreign currencies and FX with minimal margins (saving up to 3% on FX via banks);

- Advances or factoring against future receivables.

The move of the acquirers into transactional banking should not come as a surprise – this is how some of the prominent players like Wirecard have developed their business, broadened range of products and services, increased revenue, which eventually resulted in becoming a bank. Tapping into this segment of banking by acquirers is a growing trend and for e-commerce merchants it is becoming a new norm to have their current account, payments and FX with the same company that is providing e-commerce payment acceptance services.

The range of payment acceptance methods is expanding

The success of both acquirer and e-commerce merchant depends highly on how many card schemes and alternative payment methods (APMs) are accepted, as cross-border segment and specialized local APMs are becoming a significant deciding factor for the merchant, when choosing a provider. Acquirers can no longer ignore demands of their merchant’s customers to be able to accept UnionPay (China’s card scheme) MIR (Russian card scheme) or different electronic wallets, dominant in the local markets. According to Baymard Institute, up to 13% of shoppers will abandon their purchases if there’s no local payment option. So, if you’re planning to expand your business globally, you will need to offer a better payment solution for shoppers in other countries.

Image source: Clearhaus A/S www.clearhause.com

Another factor worth noting in this regard is aggregation of available payment methods within one interface. With the emergence of PSD2 and payment initiation service (PIS), some acquirers have already successfully implemented PIS on a local level, which provides safe and secure environment of direct payments from consumer bank account to the e-commerce merchant, circumvention of card schemes, AMPs and electronic wallets. However, development of this payment method for cross border e-commerce will take up to 5 years until it becomes mainstream.

Omni-channel sales are more important than ever

Consumers are using multiple channels to make their purchases online. They will research online and make the decision where to buy, based on several factors, such as price, availability, rating of the merchants, etc.

According to The 2018 Omnichannel Buying Report, 87% of consumers in the US shop offline. 78% of the survey respondents reported making a purchase on Amazon, 45% in a branded store online, 65% at the storefront, 34% on eBay, and 11% on Facebook. These numbers show how important it can be for ecommerce merchants to cater to the needs of omni-channel shoppers. Therefore, we should expect to see a rise in omni-channel selling in the coming year and a rising importance of the marketplaces.

E-commerce merchants need to make themselves visible across all of the sales channels that their shoppers use. Successful merchants are using their own store in conjunction with popular marketplaces like eBay, Amazon, Google Shopping and Jet. Apart from the marketplace leaders, there are many niche marketplaces that are successfully developing in areas like fashion, craft goods, luxury goods, auto, art, consumer electronics and home goods, as well as used products of all kinds. Such diversification of channels by means of which customers can shop, increases the possibility for merchant to increase sales.

Let’s also not forget about the popular social media platforms like Facebook, Instagram, and Pinterest, which also support direct sales. According to a report published by Worldpay in the end of 2018, 41% of UK 21 to 34 year-olds have made purchases directly through social media platforms. Now these platforms are developing a possibility for customers to directly purchase the goods, which they see in advertisements or publications, without even leaving their page. By doing so they are trying to make payments frictionless and raise conversion rates.

Some merchants are successfully experimenting with chat bots built for messengers such as Telegram and WhatsApp. It allows for sales and support to be instantly notified whilst receiving a message from customers and join the conversation after chat bot has answered all of the pre-programmed questions. This allows for customers to obtain timely information without any need of dialling or emailing the merchant, which eventually would lead to the customer leaving the page of purchase.

For merchants it is burdensome not to have a possibility of consolidation of information regarding the transactions. One of the main reasons why ecommerce merchants are staying away from multi-channel selling is that they have difficulty in managing all these channels in respect of inventory management and payment acceptance so that it becomes an omni-channel sale with concise overview.

Omni-channel sales represent both a challenge and opportunity to the acquirers. Challenges come from the widening range payments acceptance methods and integration of reporting of sales via alternative channels into merchant reporting tools. Without those, acquirers may lose to the competitors that have started offering such tools to their merchants. Opportunities are coming through an increasing number of specialized marketplaces that need omni-channel payment processing services; by onboarding such a marketplace an acquirer is gaining significant revenue streams.

Image source: FitsSmallBusiness www.fitsmallbusiness.com

Dropshipping

Dropshipping can be a profitable business model for e-commerce businesses start-ups that don’t have a sufficient capital to stock the goods. Under this model, the merchant is acting as the middleman between the manufacturer or supplier and the customer without the requirement of investing in warehousing facility and stock.

Image source: Oberlo www.oberlo.com

The merchant processes the purchase, and the product gets shipped directly to the buyer without the merchant actually handling the physical product. This business model is easy to start, involves less risk and has many advantages:

- Merchant is paying for the product only after a customer places an order;

- Merchant does not have to spend money on warehousing;

- Merchant’s overhead costs are lower than those of competition.

Dropshipping is particularly useful for selling bulky items that can take up a lot of space in warehouses and stores. That’s exactly why leading stores like Home Depot and Macy’s have adopted this business model to broaden their online reach, according to the Wall Street Journal.

However, it is not all that rosy, there are a few challenges involved with dropshipping:

- Merchants have no control over when and how the supplier ships the product, the shipping duration may be much longer than desired;

- Unless the supplier has an API, it is hard to obtain correct and valid information on how many items of specific product are in stock and feed that information to the merchant’s website;

- Out of stock refunds may overwhelm the merchant and represent a huge operational load;

- Payments and settlements may become an operational/finance headache. There is always going to be a time lag between settlements from the acquirer and payment to the supplier of goods;

- Unprofessional or unethical sellers could negatively affect the customer experience or the customer will buy from other sellers directly the next time.

From the acquirer perspective, merchants operating based on dropshipping model represent higher risk than those selling their own goods stored in the warehouses. Shipping delays, mistakes in addresses can, and will cause higher than average number of refunds and chargebacks, thus this kind of merchants needs to be monitored differently, and shipment monitoring could play a significant role in the acquirer’s risk management strategy.

E-commerce brands are going bricks-and-mortar?

Many experts are claiming that once merchant have established their sales via electronic sales channels, it might be a good idea to open a physical store as well. The logic behind it lies in the fact that for items purchased in physical stores the return rate is 9%, but this rate jumps to around 25% to 40% for items purchased online. According to the Reverse Logistics Report, the most commonly returned category is apparel and shoes ranging between 30% and 35%. With such high disparity between the return rates, it is reasonable for all merchants to establish physical presence where customers could go to review the item before ordering it online.

Presence in the physical store has a number of benefits, including:

- The ability to engage more directly with your customers;

- Build trust of potential customers (especially critical for start-ups);

- The ability to provide an enhanced experience to the customers (touch goods before you buy, receive a qualified advice);

- Experiencing a higher conversion rate than e-commerce (by far).

In the coming years we are expecting to see more and more e-commerce brands testing the storefront sales in a variety of ways, such as:

- Setting up permanent stores in prime locations;

- Setting up temporary popup shops in malls;

- Attending expos, festivals, shows and other events for marketing and sales purposes.

Demon Tweeks – largest European online store for motorsport apparel and parts, based in the UK, saw a significant growth of their online sales after they started bringing their sales truck to the racing events and most importantly to the annual Autosport International show.

Establishing a physical store is particularly effective for e-commerce merchants, whose products sell particularly well in a specific geographic area, or where the audience of an upcoming event overlaps with their target audience in some way.

From the perspective of the acquirer, if they want to retain the merchant and tap into storefront sales, it is important to be able to offer a point of sale physical terminal solution to the merchant, otherwise they might consider switching to another acquirer, who can provide both online and retail card payments solutions.

Further development of e-commerce

According to the Royal Mail’s annual UK report, laptops are the device most commonly used in the evening, while smartphones are most likely to be used at all other times of the day. In fact, since 2017, smartphone usage has increased in all locations. 78% of people now use their smartphone for online shopping whilst travelling or commuting, up from 71% in 2017. Almost half (44%) of UK shoppers like to browse online in their free time and do so called “window-shopping”. This trend is the same all across the globe and it presents a huge opportunity for both merchants and acquirers.

According to the Wolfgang Digital research (which analysed over 250 million website sessions and over €500 million in online revenue over the 12 months from July 2017 to June 2018) the online sales revenue on mobile devices has been the big mover growing by 23%. It now accounts for 32% of revenue and 53% of traffic. The merchants embracing it, have accelerated conversion and have gained substantial revenue increase amounting to around 20%.

Mobile commerce (m-commerce) is no different from e-commerce. It is rather a natural extension which further expands the available methods of purchases to the customers. On some levels, they are nearly identical, but still it is important to keep in mind some of the crucial differences which they have. Most notably it concerns: mobile image recognition, location-based services, mobile marketing, drag and drop, try-on goods on mobile screens (VR).

For acquirers, it is important to understand that the same payment methods must be differently integrated on desktop and mobile devices. The reason behind it lies in the fact that navigational capabilities presented by mobile devices are much lower than those of desktop. Hence, to increase conversion rates for m-commerce, enhancement of customers interaction and frictionless payments is a must.

For merchants, it is important to create well-designed websites allowing for customers to browse and make purchases without any hardships via mobile devices. Sadly, still some of the merchants wrongly believe that only desktop web version matters. From all devices which allow for customers to access online stores, mobile is by far the leader. Well integrated and designed m-commerce allows potential customers to search for products, compare prices, and make payments effortlessly.

Looking for the best merchant for credit card payment processing? Visit Small biz processing today to find the cheapest solution for your problems of payments in your business.

ReplyDeleteasddsa

ReplyDeleteR is a statistical programming language. You cannot really avoid R because when you talk of various algorithms you have to apply on this huge amount of data in order to understand the insights of it or in order to enable some machine learning algorithms on top of it, you have to work with R. data science course in hyderabad

ReplyDeletecover coin hangi borsada

ReplyDeletecover coin hangi borsada

cover coin hangi borsada

xec coin hangi borsada

ray hangi borsada

tiktok jeton hilesi

tiktok jeton hilesi

tiktok jeton hilesi

tiktok jeton hilesi

Optimizing your website is the first step in successful Internet marketing. Off-page promotion will drive people and search engines to your site, hikr org

ReplyDeletemmorpg oyunlar

ReplyDeleteinstagram takipçi satın al

tiktok jeton hilesi

tiktok jeton hilesi

antalya saç ekimi

referans kimliği nedir

instagram takipçi satın al

metin2 pvp serverlar

instagram takipçi satın al