EC and card schemes are closing in on inter-regional interchange fee agreement. How is that going to impact EU based merchants?

Recently Finextra.com revealed the news that Visa and Mastercard are nearing a deal with the European Commission, under which the interchange fees, EU merchants are paying on transactions, involving cards issued outside of the region, will be reduced by at least 40%. Why this news is important to the merchants in European Union? One of most significant components of card acceptance costs is the interchange fee, which in recent years became regulated in various regions. In this post I’ll be discussing what is the interchange fee, how it varies in different regions, what are the problems associated with it, and what are current initiatives to reduce it.

What is the interchange fee?

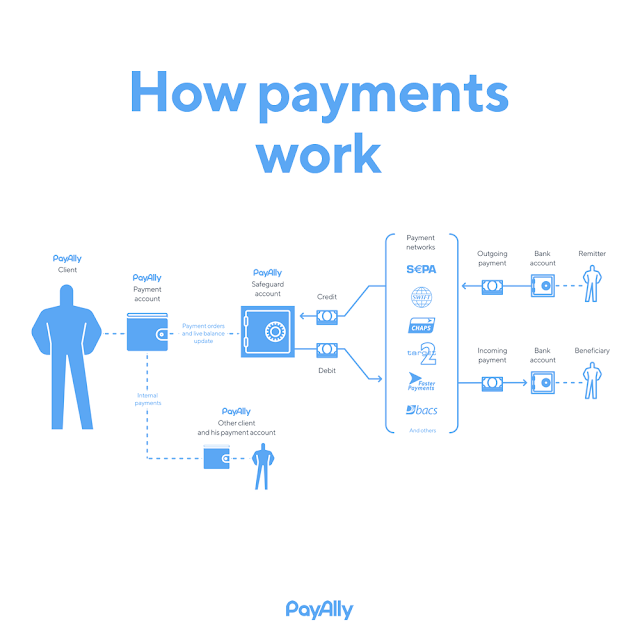

In the payment card industry, interchange fee stands for the money transferred from the acquiring financial institution (acquirer - which accepts a payment with a card) to the issuing financial institution (issuer - which issues the payment card to the cardholder) for each purchase transaction performed with a payment card at point of sale or online store. Historically, interchange fees were introduced to reimburse issuers for the interest lost consequently to the executed transaction and cessation of a cardholder’s grace period for repaying their debt. Today, it functions as a compensation of the issuer for the value and benefits which merchants receive because of accepting payments by card. Essentially, interchange fees function as a reimbursement to the issuers for providing payment cards, managing cardholders’ accounts, preventing fraud, covering bad debt costs and the risks involved in approving payments.

When a payment card transaction takes place, the issuer pays the acquiring financial institution for the purchase of the customer, while retaining the interchange fee. In its turn, the acquiring financial institution transfers to the merchant the remainder, less Visa/MC fees and acquirer fees for processing the transaction.

The interchange fees accounts for significant part of the card payment processing costs and are established directly by card networks (i.e. Mastercard, Visa). Setting rates at the correct level is very important because of two reasons. Firstly, if interchange rates are too low issuers will have no incentive to cover the risks of issuing cards. Secondly, if rates are too high, merchants may choose not to accept specific cards brands and types, as they will be disincentivised by incurring substantial loses.

Interchange fees may vary accordingly to the following factors:

1. Processing method - whether during transaction card is present, it is carried out through the Internet and etc.

2. Transaction data - the information supplied with a payment card transaction impacts how it qualifies for the interchange.

3. Merchant Category Code - specific interchange categories exist for businesses that fall under a certain merchant type.

4. Card type - whether it is Credit, Debit , Prepaid, Commercial or Premium card.

5. Card brand - this factor typically is associated with credit cards that yield some bonus for the Cardholder.

6. Card owner - whether the person owning a card is an individual, or a company.

The interchange fees normally consist of percentage from the payment amount or transaction fee. For instance, it could be 0.20% or 0.05 EUR for a transaction executed via debit card in the European Union when both issuer and acquirer are based therein.

How much is the interchange fee in different regions?

Interchange fees vary between different card networks, but we will look at only those of Visa and Mastercard since they together represent around 80% of all executed payment card transactions. Out of them, Visa is processing almost 50% of all payment card transactions and by far is the leader. As a general rule, in most jurisdictions, there are higher interchange fees for the transactions executed with Commercial Cards vis a vis a Consumer Cards. Such discrepancy exists due to the higher risks of chargebacks and fraud, which are brought by transacting with Commercial Cards.

Interchange in the EU

The European Union is the region in which interchange fees are strictly regulated by the authorities. In April 2015 the EU passed a Regulation (EU) 2015/75 on interchange fees, which became applicable in December of the same year. It imposes caps on interchange fees within the European Economic Area (EEA) and aims at the elimination of fragmentation of the internal market. As such, in the EEA interchange fees are capped at 0.30% for Consumer Credit Cards, and at 0.20% for both Debit and Prepaid Cards.

For consumer financial products there is no difference which type of processing method was used to execute the transaction, be it POS, NFC, UCAF and etc. The Regulation's requirements apply to all card-based payment transactions carried out within the EEA, where both the issuer and the acquirer are located therein. For Debit and Prepaid Cards Member States may define the transaction cap lower than the stipulated limits or impose a per transaction interchange fee of no more than 0.05 EUR.[1]

The regulation was passed since retailers, who subsequently pass them to consumers by increasing the prices of products, indirectly pay interchange fees. This regulation did not consider limiting the Commercial Cards and the interchange fee rate in the EEA is substantially higher starting somewhere around 0.68% and ending at 2.05%.

Interchange in the US

In the US interchange started to be regulated in 2011 with the establishment of the cap at 0.05%+0.22USD for Consumer Debit and Prepaid Cards. This cap functions in accordance to the cost-plus methodology, which allows double payment for the same transaction. The interesting aspect about the US interchange is that such cap has exemptions for Credit Cards, small issuers (having assets less than 10 billion USD) and Commercial Cards. Because of these various exemptions, the interchange fee in the US varies somewhere between 0.05%+0.21USD to 1.90%+0.25USD for Debit and Prepaid Cards. For Consumer Credit Cards it varies on average between 0.75% to 2.95%+0.10USD. Interchange fee for Commercial Cards varies from 1.90%+0.10USD to 2.95%+0.10USD.[2]On average non-regulated interchange fee in the US is 0.80%+0.15USD.

Interchange in China

In 2016 September, China has passed a legislation, which consolidated interchange fees and capped them at 0.35 for Consumer Debit and Prepaid Cards, and at 0.45% for Consumer Credit Cards.[3]Differently from other already discussed jurisdictions, this cap applies for Commercial Cards as well. The legislation differentiates by the card type (debit versus credit) rather than by the industry merchant type, which is applicable in various other jurisdictions. This legislation simultaneously capped the amount, which will be due to the card association executing the transaction at 0.065%. It created “exemption on public welfare”, which states that to non-profit institutions acting in the interests of public (e.g. schools, medical institutions) applicable interchange must be 0%.

Interchange in Russia

Russia did not consolidate interchange fees and they vary somewhere between 1.10% and 2.10% for Consumer Cards, depending on the type of the product purchased by the customer, the processing method and card brand. For Commercial Cards interchange fee is substantially higher, starting at 1.45% and ending at 2.15%. Currently, Russia is considering placing restrictions on interchange fees, so they would be below 1%. However, so far this initiative is only on a discussion level.

A new initiative by EU to curb cross-border interchange in EEA

Because of varying interchange fees in different regions, the inter-regional transactions do not fall under the applicable caps. Hence, transactions which are executed in the region having lower interchange fees with a card issued in the region with higher interchange fees will have higher costs. For instance, when a merchant based in the EEA, with European acquirer, accepts a card from a US cardholder who has a US issuer the interchange from the US will be applicable. Such situations motivate merchants accepting payments by cards issued outside of EEA to raise prices for goods and services. In its turn, it creates a disadvantage for the local consumers as they are paying more without receiving any benefits.

So in real life, what is the cost of card payment acceptance for the EU based retail merchant, selling goods over POS, assuming that card network fees and acquirer fees combined are 1.1%:

Customer payment by credit card issued in EU: 0.3% Interchange + 1.1% card network and acquirer fees = 1.4% total

Customer payment by credit card issued in USA: 1.8% Interchange (averaged) + 1.1% card network and acquirer fees = 2.9% total

Customer payment by credit card issued in China: 0.45% Interchange + 1.1% card network and acquirer fees = 1.55% total

Customer payment by credit card issued in Russia: 1.60% Interchange (averaged) + 1.1% card network and acquirer fees = 2.7% total

The European Union became concerned with this situation and started to investigate Visa and Mastercard with regard to anticompetitive practices. Subsequently to the probe, Visa and Mastercard proposed a settlement, which would limit inter-regional interchange fees in the EU. Currently, they suggested establishing caps on inter-regional interchange fees for card present transactions at 0.20% for Debit and Prepaid Cards, and at 0.30% for Credit Cards. For online payments, where the card is not physically present, they proposed to establish caps at 1.15% for Debit and Prepaid Cards,and at 1.50% for Credit Cards. Arguably, such commitments of Visa and Mastercard would reduce inter-regional interchange fees by 40%. As well, they would publish a schedule of inter-regional fees on their webpages as to ensure transparency.[4]

What else regulators need to do to ensure reduction of cost to the merchants?

The described initiative in the EU to curb the interchange fees is expected to allow consumers to receive the benefit of seamless transactions and lower costs. However, interchange fees are only part of the processing costs. Other elements (such as card scheme fee and processing fee) are involved in acquiring and should be considered simultaneously. Since most consumers are not aware of the various elements present in the transactions, such blind spotting creates an opportunity for merchants to receive more money for the same products/services without making any amendments to the prices. If the EU is intending to regulate this field, it should do so on a package basis whilst considering all of the elements present in the execution of transactions.

Comments

Post a Comment